Proxinvest is a leading independent company providing advice on voting at General Meetings and analysing the governance of listed companies.

- A single business line, several disciplines, 25 years of experience

- A pioneer and leader to define the best practices

- Proximity to each customer, a complete,segmented, adaptable service

- A large universe of coverage of listed companies

-

Independence: a guarantee for investors

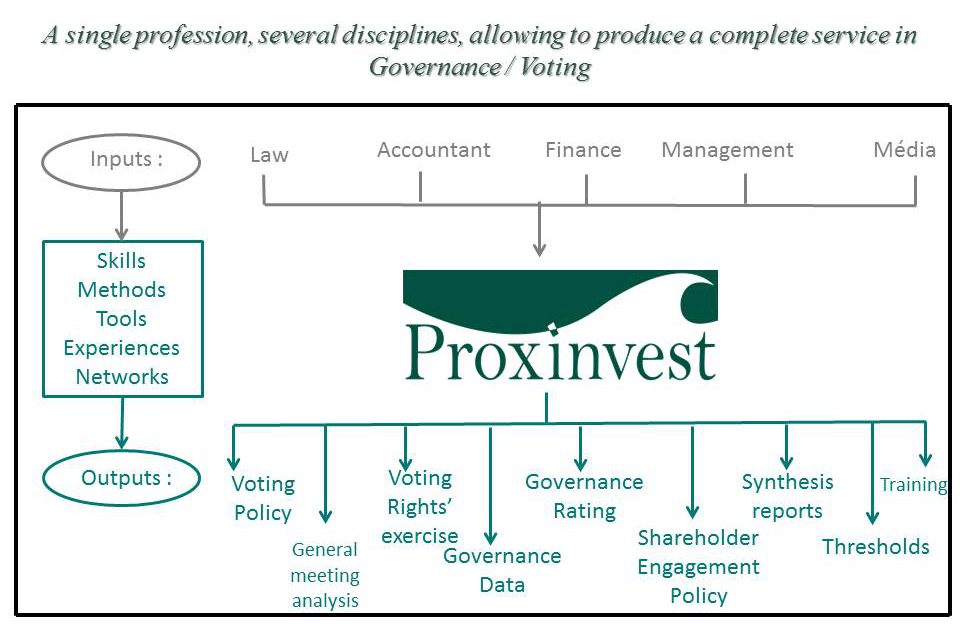

One profession, several disciplines, 25 years of experience

- Since its inception in 1995, Proxinvest has focused on the business of corporate governance analysis and shareholder voting advice at AGMs.

- Over these 25 years, Proxinvest has accumulated a detailed knowledge of the universe of listed companies in the field of Corporate Governance and related Regulations and Legislation.

- A unique relational network has been built up, making it possible to follow the evolution of both issuers and the environment governing relations with their shareholders.

- A close-knit multi-disciplinary team (in Law, Finance, Accounting, Top Management) has been set up, enabling the understanding and monitoring of this universe.

A pioneer and leader to define the best practices

- As early as 2006, Proxinvest fully published its Voting Policy in order to promote corporate governance practices among issuers and investors.

- In 2012, the AMF, at the instigation of Proxinvest, set up a working group (Poupart-Lafarge group) to examine the ability of shareholders to exercise their voting rights at general meetings. In 2016, at the request of Proxinvest, the AMF set up a working group on shareholders’ meetings within its ” Investors” commission.

- Proxinvest is regularly consulted on governance issues by bodies and authorities (EU, Minister of Economy and finance, AMF…).

Proxinvest’s methods are aimed at defending the interests of all shareholders regardless of their share in the capital.

Independence : a guarantee for investors

- Independence from issuers

- Proxinvest is a member of the Circle of Independent Analysts.

The advantages of our independence for our clients

Absence of conflicts of interest that may :

-

Mask the economic reality

- Allowing the diversion of behaviour

- Encouraging complacent voting

Examples: loss of value through regulated agreements, misappropriation of wealth through abusive mergers and acquisitions.

Avoiding the risk of breach of ethics for investors vis-à-vis their customers.

A large universe of French issuers monitored in Paris, and access to global coverage with Glass Lewis

-

Proxinvest has set up a professional and flexible organisation in Paris, which enables it to provide direct coverage of the first 250

capitalisations

of the CAC All-Tradable and any other company at the client’s request throughout the year, while dealing with the strong seasonality of the AGMs. Each issuer is monitored by a Senior Analyst.

- Proxinvest, via Glass Lewis ensures access to global coverage.

For France, in 2020, Proxinvest thus monitored 322 General Meetings and gave voting recommendations on 7,316 resolutions.

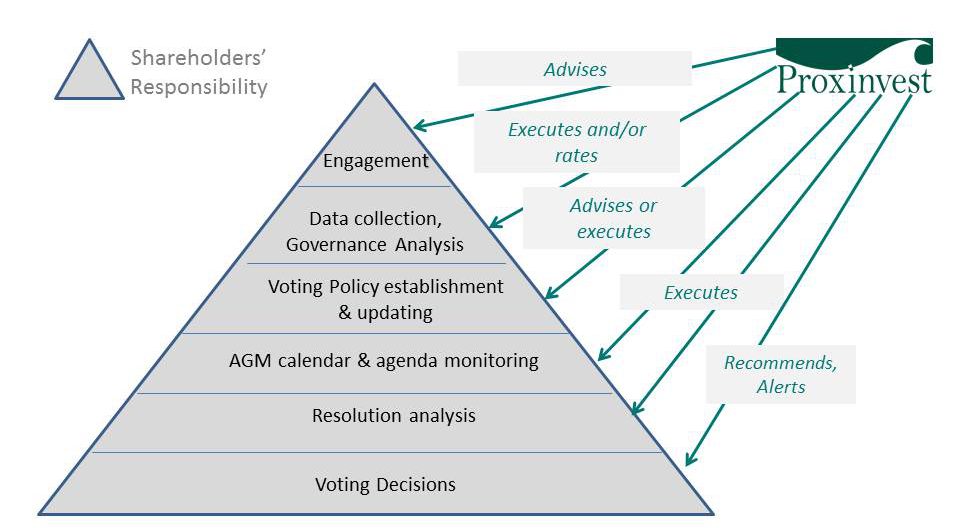

Proximity to each customer, a complete, segmented, adaptable service

-

This in-depth knowledge of the world of issuers and their monitoring is made available to our customers, thanks to a dedicated organisation that combines reliability, technical expertise and proximity:

- Proxinvest offers a comprehensive service covering the entire chain of shareholder responsibility in terms of governance analysis and voting advice, accessible either by segment or as a whole, adaptable to the specific needs of each investor.